The Personal Consumer Expenditures (PCE) price index indicates annual inflation dropped to 2.1% in September, a slight decrease from the 2.3% reported in August. This figure is more in line with the Federal Reserve’s inflation target of 2% per year.

The Federal Reserve has struggled to bring inflation under control since measures implemented during the pandemic. That included raising key interest rates to reduce borrowing.

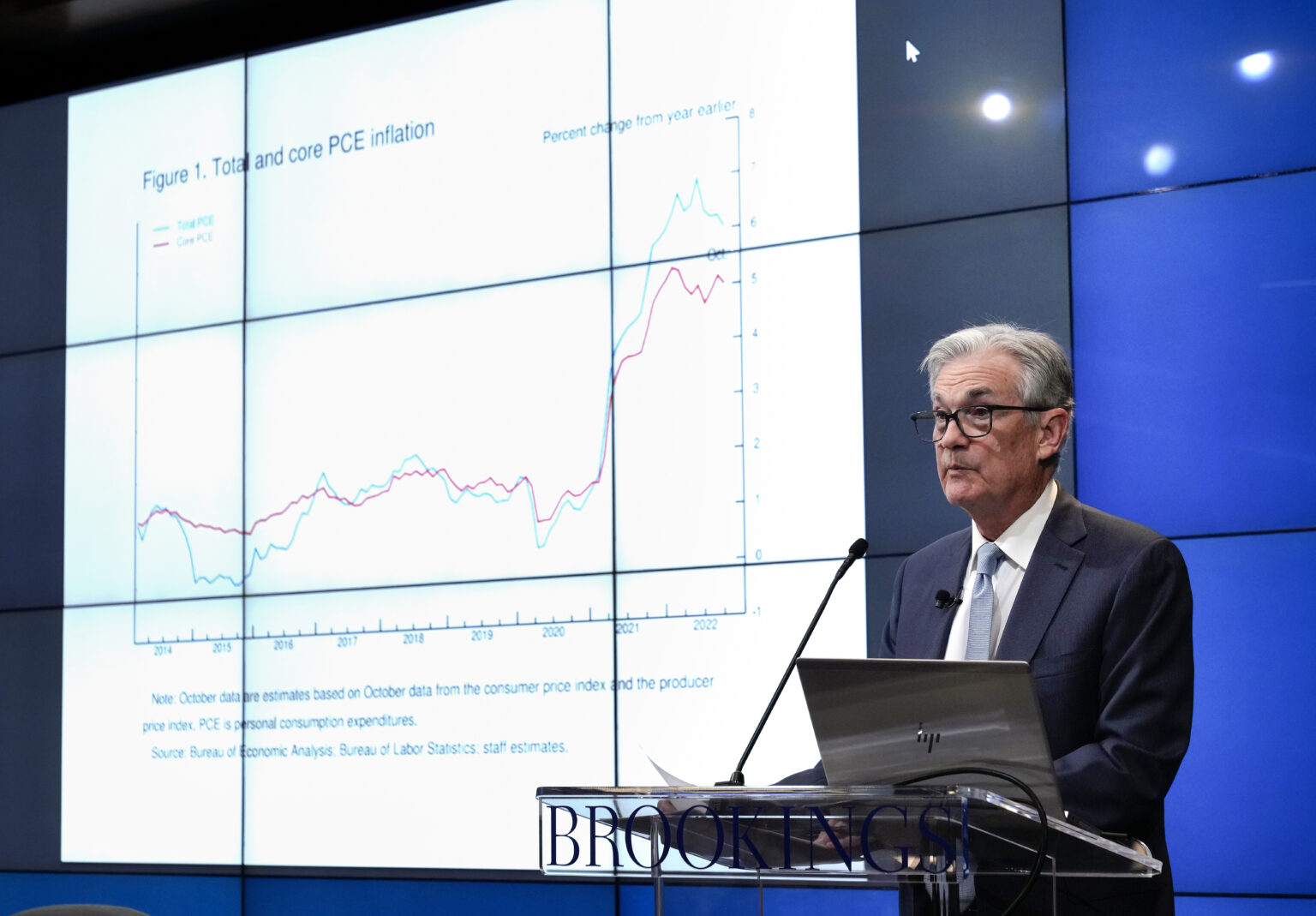

Inflation peaked at 7% in 2021 and only feel to 6.5% in 2022. It dropped to 3.4% as the Federal Reserve dug in its heels and maintained high interest rates to combat it.

A separate indicator called the “core” PCE, which removes food and energy costs from the equation, still remains relatively high at 2.7%. It remained relatively steady compared to previous months. However, it was slightly higher than economists’ expectation of 2.6%.

Some Federal Reserve officials admit that they had initially been slow to respond to increased inflation in 2021 because it interpreted the rise as pent-up consumer demand for activities such as dining out and traveling after quarantine and social distancing restrictions were lifted.

Since then, it reversed course and began aggressively raising the interest rates at which banks can borrow money. The Federal Reserve maintained the federal funds rate at 5.25% to 5.5%. In September, it cut interest rates by fifty basis points, or half a percent, the first cut in over four year’s.

With inflation cooling, the Federal Reserve is expected to cut the interest rate again at its meeting later this week.

Even though the inflation rate has dropped significantly since 2022, it still caused frustrations for the Biden Administration and Kamala Harris’ presidential campaign. Several of Kamala Harris’s economic proposals are geared at tackling inflation and it was a topic she spoke frequently about on the campaign trail.

Lower-income families felt the impact of inflation the hardest. The rapidly rising cost of essentials like food and energy made it more difficult to stay within budget, causing more Americans to rely on credit cards.

By way of comparison, inflation never rose above 2.3% during the Trump Administration. However, many of the pandemic measures implemented in his final year in office. Generally, inflation doesn’t “hit the register,” until some time after enacted. In other words, the impact of economic policies from 2020 would likely be seen in economic indicators the following year.

Even though the price of some essentials like gasoline dropped slightly year-over-year in October 2024, the imminenet election may have played a role.

A recent Harris Poll also indicates that half the likely voters believe the United States’ economy is in a recession. This may have been spurred by consumers having to scale back their spending due to rising prices.

Other indicators, such as a better-than-expected jobs report for September, may indicate that other parts of the economy remain healthy.

Still, the inflation rate is starting to fall more in line with the Federal Reserve’s goal of 2% annually. It may have helped that the Federal Reserve started to take inflation more seriously after assuming that it would taper off on its own after COVID-19 restrictions were lifted in 2021.