The announcement of President Donald J. Trump, as the 47th president of the United States of America was welcomed by Tesla and its Chief Executive Elon Musk—for more reasons than one.

Trump’s victory is expected to be a big win for Elon and Tesla investors, and the market reacted accordingly. While Tesla shares soared, rival EV makers saw declines. Rivian shares dropped by 9%, Lucid Group fell 3.1%, and Chinese EV maker NIO slid 6% on Wednesday.

Meanwhile, Tesla stocks rose by over 30%, from just under $245 per share when the market opened on Monday to over $320 by the week’s close.

The market’s reaction likely reflects discussions that have happened between Musk and Trump leading up to the election. Wall Street is betting that some, if not all, of these proposals could be realized under a Trump presidency.

Musk has been one of Trump’s biggest supporters during his campaign, donating nearly $119 million to a political action committee he set up to support Trump, according to Federal Election Commission filings.

Over $44 million of that came in the last week of October, just over a week before Americans went to the polls.

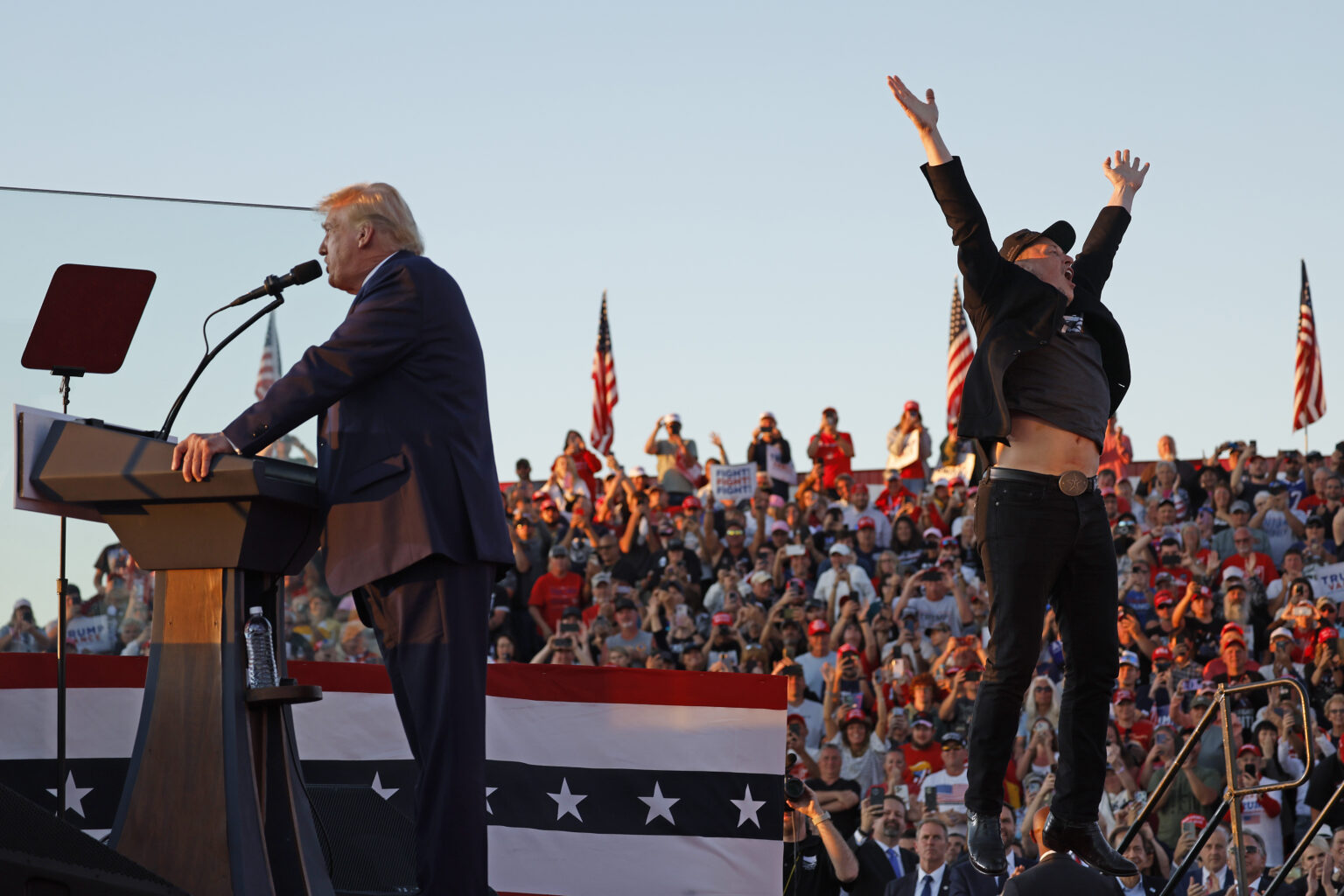

Musk also hit the campaign trail with Trump at rallies and hosted an interview with him on X, his social media platform.

Even though Trump doesn’t take office until Jan 10, Wall Street analysts are anticipating a boon for Elon and all his subsidiaries.

The reason why is simple: On October 27 at New York’s Madison Square Garden, Musk was one of the speakers at an all-day Trump rally. He was introduced by Cantor Fitzgerald CEO Howard Lutnick, who quppied that he and Musk were co-founders of the envisioned “Department of Government Efficiency.”

Musk pitched the idea of a Department of Government Efficient to Trump during his September interview with the incoming president. Musk proposed the department’s role would be to oversee other federal departments, claiming it could cut at least $2 trillion from the federal budget.

“I think it would be great to just have a government efficiency commission that takes a look at these things and just ensures that the taxpayer money, to the taxpayers’ hard-earned money is spent in a good way,” Musk said. “And I’d be happy to help out on such a commission.”

Trump seems receptive to the idea: “I’d love it.”

While he didn’t mention which departments are on the chopping block, Musk has had problems with several federal agencies, including the SEC, Environmental Protection Agency, and Federal Aviation Administration, who he claims overreach their authority and suffocate innovation with regulation.

Tesla also has several pending court cases, ranging from racial discrimination to deceptive advertising regarding the autopilot and full self-driving features.

The National Highway Traffic Safety Administration (NHTSA) opened a probe into Tesla’s equipped with the full self-driving feature after reports of multiple crashes with two fatal incidents.

A Trump Administration could mean that he may not have to contend with regulatory bodies over the safety and efficacy of his true self-driving cars (yet to be made)—which is a big win for Tesla investors.

With regard to worker protections, Musk has been battling the National Labor Relations Board, looking to strike down their authority through litigation. Should Trump capitulate and allow Musk the freedom he desires, he will no longer have to worry about federal suits.

Policies like Biden’s Inflation Reduction Act, which provides tax incentives to companies who make electric vehicles and consumers who purchase these E.Vs. The Inflation Reduction Act also included incentives for homeowners to make energy-efficient upgrades to their homes, including tax credits for installing solar panels, which Tesla is a market leader for.

Interestingly, despite the promising headwinds, the win may not be as straightforward as Tesla investors have been betting. After all, the fossil fuel industry also poured million into Trump’s campaign and have their own interests to protect.

Experts, such as Wedbush analyst Dan Ives, have predicted that Trump’s desire to reduce EV mandates will likely hurt Musk’s competitors more than it hurts Tesla due to its volume of sales.

Much of Musk’s massive net worth can be traced to the government support his companies, such as Tesla and SpaceX, have received over the years, totaling over $15 billion over the last decade.

However, Trump’s decision to increase tariffs on imports could negatively—and positively—affect Musk. At the same time, it would deter Tesla’s Chinese competitors BYD—which at a time overtook Tesla as the world’s largest EV maker—and NIO from “flooding the U.S. market over the coming years.”

With Trump reentering the White House in January, Elon is well positioned to leverage his position and obtain the access, resources, and regulatory oversight he needs to expand his empire.