Warren Buffett, the renowned investor and CEO of Berkshire Hathaway, has long emphasized the importance of making thoughtful, long-term investment decisions.

However, some of the Oracle of Omaha’s core investment philosophies extend beyond the world of finance. Buffet has stressed that the most important financial decision you’ll ever make has nothing to do with stocks or markets. Instead, it revolves around a more personal choice—one that can shape your entire financial journey and life trajectory.

“You want to associate with people who are the kind of person you’d like to be. You’ll move in that direction,” Buffett says. “And the most important person by far in that respect is your spouse. I can’t overemphasize how important that is.”

He asserts that the spouse you choose can have an outsized influence on the direction of your life, impacting your happiness, success, and financial well-being.

Buffett’s investment philosophy “only buy if you intend to hold — possibly forever” applies not just to his stock portfolio, but also to personal relationships.

Like his decision to invest in American Express in 1991 and Coca-Cola in 1998, which were made with the intent of holding onto them for decades, Buffett’s applies many of the same principles that have made him one of the most successful investors of all time.

In fact, Buffett credits much of his own success to his late wife, Susan Buffett. In the 2017 HBO documentary Becoming Warren Buffett, he reflects on how his late wife shaped his life.

“What happened with me would not have happened without her,” he says.

Though the two separated, the remained close friends and business partners. Susan Buffett passed away in 2004 at the age of 72.

Research backs up Buffett’s claim.

A 2014 study from Washington University in St. Louis found that having a supportive partner can enhance career success and life satisfaction. By extension, a quality partner also increases earning potential and financial security over time.

The study correlated “partner conscientiousness” to better performance at work, higher likelihood of promotions, and an overall more fulfilling life.

Conscientious partners tend to manage household tasks more effectively, exhibit pragmatic behaviors, and create a stable environment that allows their spouse to focus on work and personal growth.

This insight is particularly relevant for those considering marriage or long-term commitment. While it might sound simplistic, your partner’s habits and outlook on life will deeply influence your own.

As Jim Rohn famously said, “You are the average of the five people you spend the most time with” — and no one affects you more than your spouse. If your partner has good habits, whether in financial planning, time management, or household responsibilities, those habits are likely to rub off on you.

The reverse is also true: Being a conscientious and supportive partner can inspire similar behaviors in your spouse. Instead of expecting your partner to change, leading by example and taking on more responsibilities can create a positive feedback loop, where both partners enhance each other’s success.

In parallel, opting out of marriage also carries financial ramifications — especially against the background of today’s inflationary environment and housing crisis.

Owning a home has been a critical step in gaining equity stability and building long-term financial stability. However, for most Americans, buying a house on a single income is becoming increasingly out of reach.

But one variable may be that Millennials and Gen Z are delaying marriage. By extension, they are also holding off on combining incomes to build future financial security.

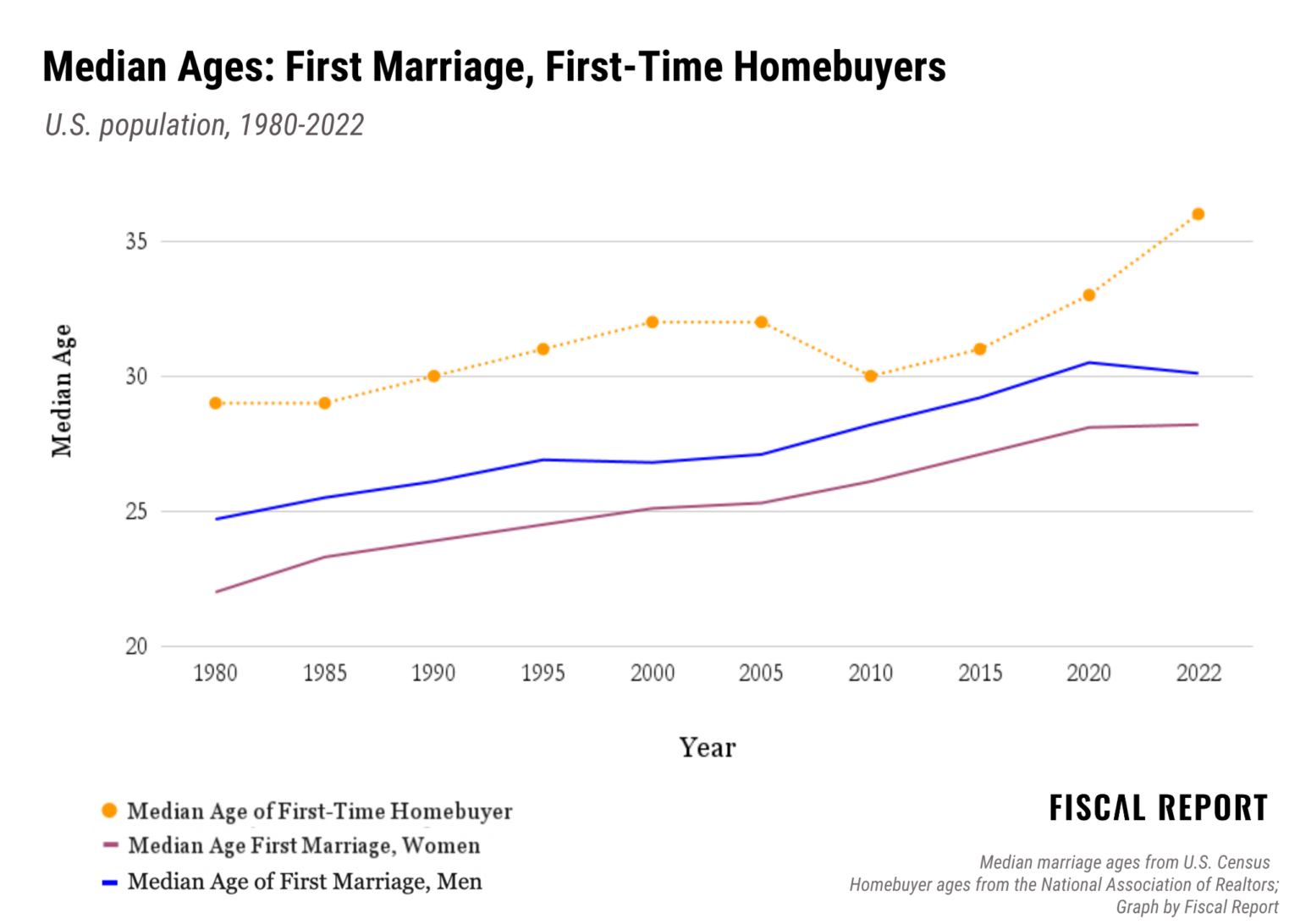

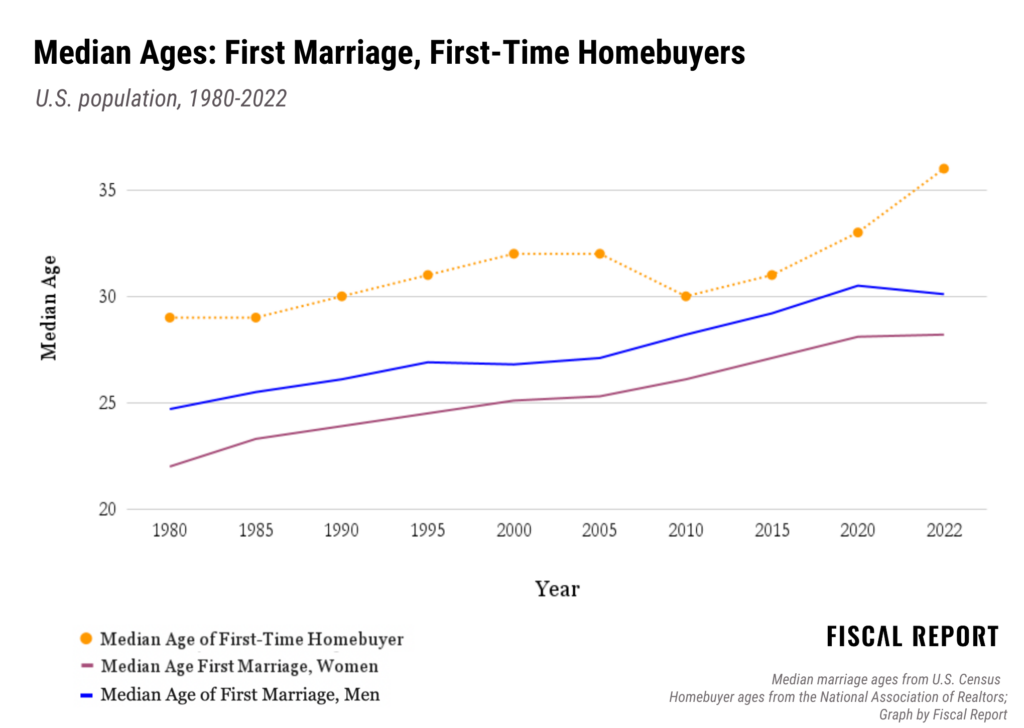

Between 1980–2022, the median first-marriage age for men increased from 24.7 in 1980 to 30.1 in 2022 — up 5.4 years. Over the same period, the median age of first-marriage for women rose from 22 to 28.2, up 6.2 years since 1980.

In parallel, during the same period, the median age of first-time homebuyers rose by just under seven years, from 29 in 1980 to 36 in 2022.

Starter homes in the U.S. have the fastest-rising prices, making it increasingly difficult for many Americans to enter the market.

This makes teaming up financially one of the only viable options for those seeking footing in the housing market.

After a few years of building equity in a home, owners have more options, even before they’ve fully paid it off. Home equity lines allow for access to funds in case of an emergency — or for other investment ventures, like starting a business.

Moreover, paying off a mortgage during prime working decades makes retirement more safeguarded. Rent and mortgages are typically a household’s single largest line-item expense, so paying off a home lightens the day-to-day financial burden in retirement.

But there’s yet another way a partner can significantly impact your financial future — to the downside. Not financially merging with a partner may be wiser than risking the potentially severe consequences of choosing the wrong partner.

The average divorce costs around $20,000, but more complicated situations can easily soar into the six and seven-figure categories. Between attorney fees, asset division, child support, and more, divorce can reach into every aspect of finances — including retirement savings. The more contentious the divorce, the more costly it gets.

According to the U.S. Government Accountability Office, both parties are typically adversely affected by a divorce, with women generally taking a larger hit. On average, men experience a 22% cut in household income; women’s drops by 41%.

Related: The Economics of No-Fault Divorce

As Buffett suggests, a good partner doesn’t just influence your personal life—they set you up for professional and financial success. Being part of a mutually supportive team helps ensure long-term happiness and stability, both emotionally and financially.

Moreover, teaming up with someone financially is an integral component of establishing economic equity and long-term financial security.

By aligning with a conscientious partner, or by working together to improve each other’s habits and attitudes, you create a foundation that supports not just career success, but a fulfilling and rewarding future.

For many, it’s the most important financial decision they’ll ever make.