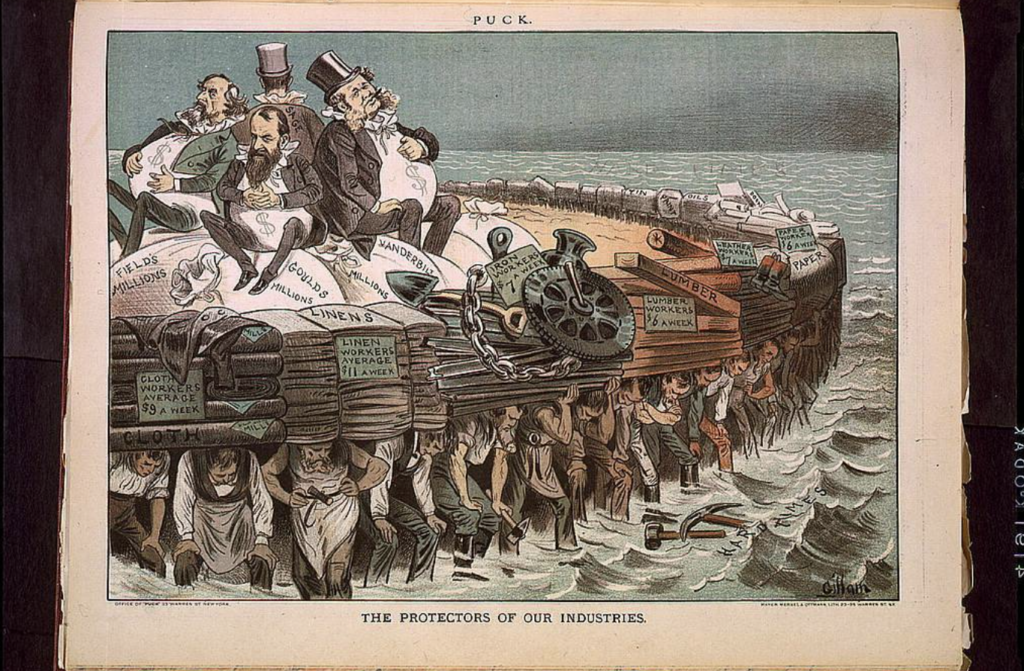

History may be repeating itself. Many economists believe the United States is in Second Gilded Age. Wealth inequality outpaced historic precedents as of July 2024.

“America’s roughly 800 billionaires are collectively worth a record $6 trillion as of July 11, the most money ever amassed by the nation’s ultra wealthy,” said the Tax Fairness Report.

Billionaire wealth has doubled, with numbers up by $3.1 trillion since the passage of Donald Trump’s 2017 Trump-GOP tax law. While the Tax Cuts and Jobs Act had provisions that fiscally benefited all Americans, it only did so temporarily. However, the 14% tax cut for corporations is permanent.

“The failure to adequately tax the astronomical growth in billionaire wealth over the last quarter century has helped create this unprecedented concentration of financial power,” said David Kass, ATF’s executive director.

Americans are suffering from the consequences of inflation, which weakens the middle class as wealth inequality grows.

“The middle class shrank by over 10% over the 52-year period ending in 2023,” reports US News.

Between 1971-2023, cumulative wealth of the richest Americans grew by 8% while the lower class’s only grew by 3%.

“The upper class’s share of overall income has increased from 29% to 48% over the same period — and surpassed the middle class in 2009,” reported US News.

Trump is not the first to pass billionaire-friendly laws at the expense of the middle and lower classes.

Predating him is the half-off tax discount and the protection of capital gains from any taxation which disproportionately protects billionaire wealth. Moreover, it gives them the leverage to accumulate even more wealth.

Related: Top 10% of Americans Have More Than Double The Wealth of Bottom 90%

Closing the Wealth Inequality Gap

President Biden is introducing measures that work towards reducing historic wealth inequality by:

- Implementing a 3.8% investment-income tax on investment profits for American’s bringing in more than $200,000 per year

- Closing the stepped-up basis loophole on the highest incomes, which evades a taxation event on asset inheritance. It works by readjusting the underlying asset’s purchase price to current market value at the time of asset transfer. In effect, it eliminates any “gains” on the asset, which would become taxable at time of sale.

- Example: An investor buys a rental property for $200,000. After 10 years, that same property is worth $300,000. If sold, the $100,000 gain would be subject to a capital gains tax of up to 20%. However, if they pass that asset — including the gains — onto an heir, the underlying purchase price is adjusts to $300,000. That zeroes out otherwise taxable gains leading up to the transfer.

- This provision alone is expected to raise $235 billion in tax revenue annually. The stepped-up basis tax is considered a loophole that benefits the ultra wealthy, shielding them and their families from any taxable events on their legacy assets. The Americans for Tax Fairness call this loophole “accounting fiction.”

- Though closing this tax loophole is part of Biden’s proposal, no bill has been introduced in Congress.

- Example: An investor buys a rental property for $200,000. After 10 years, that same property is worth $300,000. If sold, the $100,000 gain would be subject to a capital gains tax of up to 20%. However, if they pass that asset — including the gains — onto an heir, the underlying purchase price is adjusts to $300,000. That zeroes out otherwise taxable gains leading up to the transfer.

- Annual taxation of the unrealized gains of the nation’s wealthiest households. Currently, any gains made on capital investments are only taxable when the asset at point of sale. Should the investor keep their capital tied up in real estate, equities, and other investment assets, they may never face taxation. However, they can leverage gains as collateral for capita,l which in turn, buys more assets.

- Taxing the value of the biggest fortunes through the Ultra-Millionaire Tax. The bill awaits a formal Congressional vote). The passage of this bill would levy a 2% tax on trusts worth between $50,000,000.00–$1,000,000,000.00. and a 3% tax on trusts worth more than $1,000,000,000.00.

The Gilded Age of the 1870s

The American Gilded Age took place from the 1870s to the early 1900s. It was a time of extreme wealth for the wealthy, but extreme poverty for the lower class, according to Investopedia.

The Gilded Age began to collapse during the Panic of 1893 when the two largest employers in the country shut down, according to History.com. Other contributing factors were tax reform, muckrack journalism, unionization of the workforce forcing labor reform, more regulations, civil rights, and election reform. These changes found support with Theodore Roosevelt’s Administration.

Americans For Tax Fairness believe that this billionaire wealth is used to “distort our democracy.” They, along with millions of other struggling Americans, call for change.

Related: Billionaires Endorse Trump After Assassination Attempt

More than $9 billion dollars has been invested into campaigns during 2024 elections, including the presidential, Congressional, and state official elections. As of May 2024, more than 65% of these funds came from political PACs.