The Consumer Financial Protection Bureau (CFPB) published guidance aiming to aid federal and state consumer protection authorities in halting banks from levying overdraft fees based on purported opt-in agreements without evidence of consent from consumers.

This practice of proclaiming customer consent devoid of documentation is referred to as “phantom opt-ins.”

Consumer Rights and Bank Obligations

The Electronic Fund Transfer Act forbids banks from imposing overdraft fees on ATM and one-time debit card transactions sans the affirmative opt-in approval of consumers.

In a recent press release, the CFPB has uncovered incidents where banks lacked paperwork showing this permission was obtained before levying overdraft fees.

“No Americans should incur bank account fees they never assented to,” CFPB Director Rohit Chopra says.

When patrons withdraw funds or make purchases that bring their account balance under $0, banks can either decline the transaction or cover it by providing an overdraft loan.

Banks can only charge for overdraft loans on ATM/debit transactions if the customer opts into the bank’s overdraft service.

Banks also levy “non-sufficient fund” (NSF) fees when they reject transactions due to insufficient balances. These fee amounts are frequently similar to overdraft charges.

The CFPB’s guidance advises consumer protection officials to operate under the assumption that opt-in consent does not exist unless banks can furnish definitive proof.

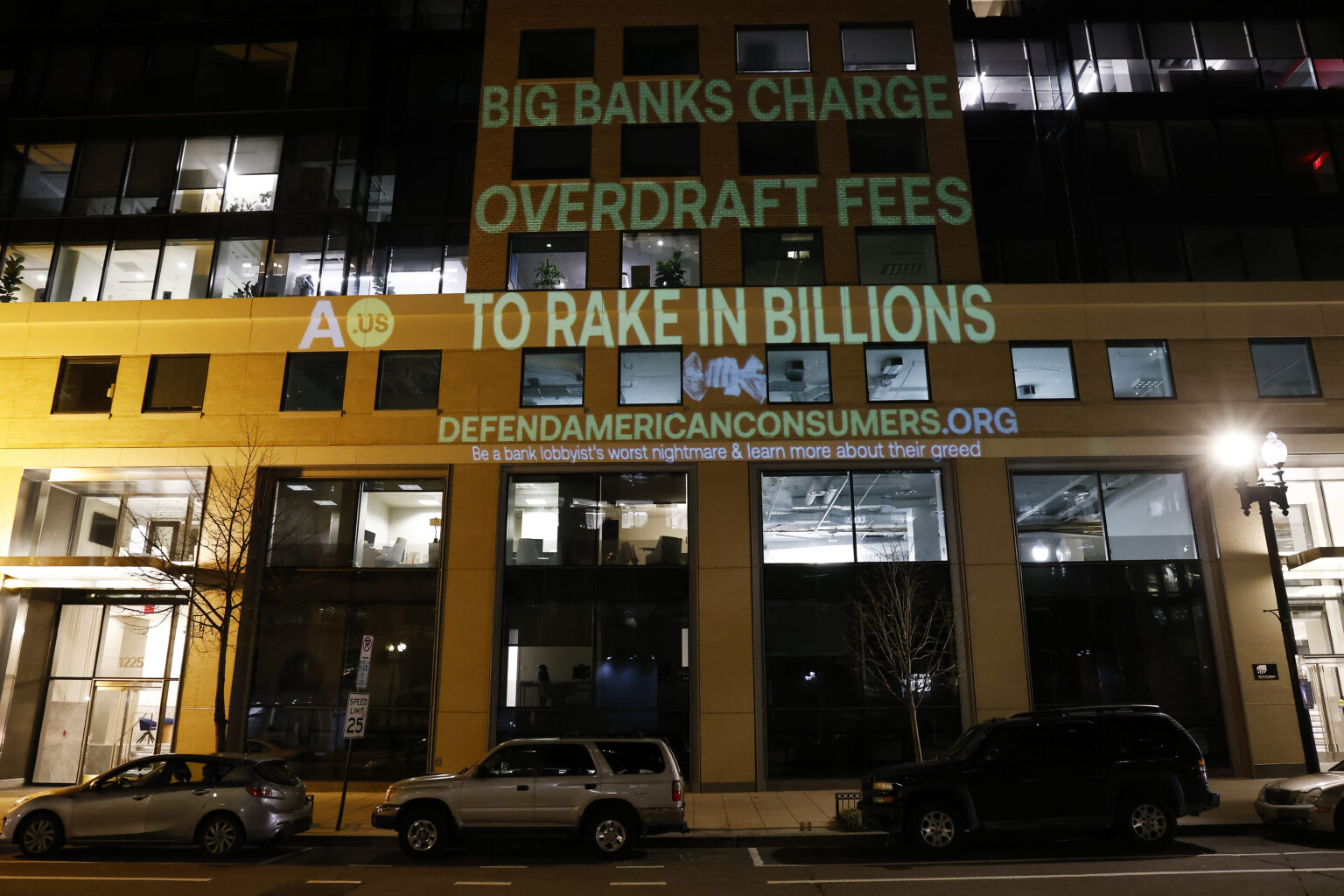

CFPB Takes Aim at Overdraft and NSF Fees

In fact, the CFPB has taken action in cases where financial institutions created barriers deterring consumers from avoiding overdrafts.

In September, the agency ordered Regions Bank to refund $141 million in “surprise overdraft fees” to customers and an additional $50 million to the CFPB’s consumer relief fund. TD Bank, Atlantic Union Bank, and TFC National Bank also had multi-million dollar fines levied in 2023.

After the CFPB began addressing these “junk fees,” several banks reformed their overdraft policies. In total, the reforms saved consumers $4 billion annually in overdraft fees and nearly $2 billion in NSF fees.

The Impact of Regulatory Pressure

In 2015, the agency mandated banks with more than $1 billion in assets report yearly overdraft fee revenue.

In an April press release, the CPFB presented detailed trend data on overdraft and NSF fees.

After the requirement was imposed, qualifying banks reported a collective $11–12 billion dollars per year between 2015–2019.

Due to pressure and regulatory changes by the CFPB, banks revised their overdraft policies in late 2021 and early 2022. In the years that followed, bank revenue from overdraft fees dropped significantly. Bank overdraft fee revenue was down 51% in 2023 ($11.9 billion) compared to 2019 ($5.8 billion).

Despite a 46% decrease in overdraft revenue since 2019, J.P. Morgan Chase remains the top bank for overdraft fees. The bank reported $1.1 billion in overdraft fees in 2023 compared to $2.06 billion in 2019.

Trailing close behind them, Wells Fargo brought in $937 million in overdraft fees in 2023—a 46% decline from the nearly $1.7 billion the bank raked in in 2019. Chase and Walls Fargo brought in nearly four times as much in overdraft revenue than other large-scale banks.

Bank of America seems to have made the most drastic change in policy. The bank reported $1.5 billion overdraft revenue in 2019 and $140 million in 2023 — a 91% decrease.

The CFPB continues to push for stronger consumer protections, ensuring that fees are only levied with clear, documented consent.