More than five million account holders have transitioned to Login.gov to access the personalized tools now provided online by the Social Security Administration (SSA).

The change is part of a larger effort by the agency to ensure account security and combat fraud.

Social Security Fraudulent Activity on the Rise

According to a July 18 report by the Office of the Inspector General of the Social Security Administration, Social Security-related scam allegations increased by 31% between Q2 of 2023 and Q2 of 2024. The most common types of scam allegations included:

- Scammer reported a problem with someone’s Social Security Number (44% of complaints)

- Scammer impersonates an official from a government agencies (37%)

- Using forged federal documents with official government logos to collect sensitive information (32.7%)

Scammers use these tactics to takeover Social Security accounts and identity. They use this information to open credit lines in other people’s names, collect benefits and tax refunds, and harm the real account holder’s credit.

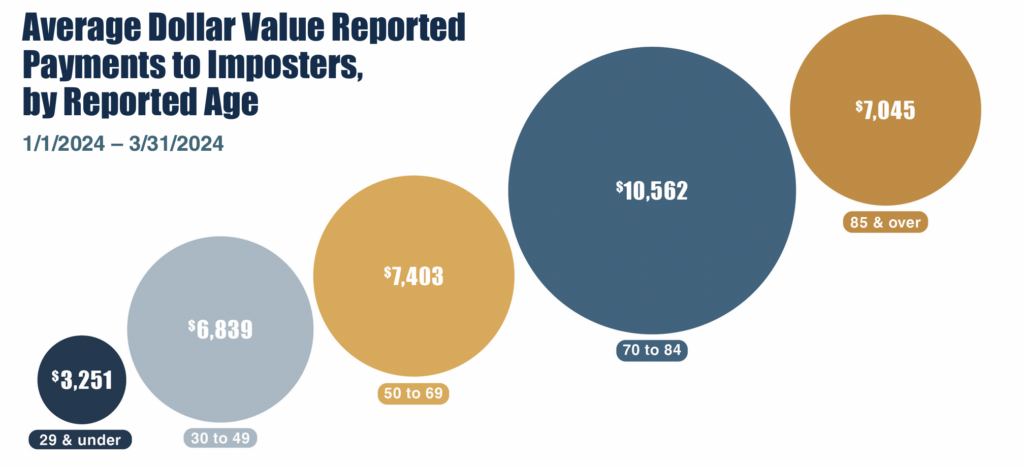

These forms of fraud had real material losses for its victims. On a per-capita basis, those aged 70–84 suffered the most, averaging $10,562 per loss.

Bolstering the Security of Social Security

According to the Social Security Administration’s press release, the change will enhance cybersecurity and ease of use across various government agencies. It will also streamline access to benefits and support services while combating the tactics used in scams.

Related: Google Eyes $23 Billion Acquisition Deal With with Cybersecurity Startup WIZ

The SSA encourages account holders to create their accounts to access future benefit estimates, request a replacement Social Security card, check application statuses, and securely manage their benefits.

This transition includes account holders who created a ‘my Social Security account’ before 2021. It does not affect existing Login.gov or ID.me account holders.

Login.gov and ID.me are credential service providers that (username, password, and two-step verification) to verify account holders’ identities. Both services require the user to submit photos of a valid, government issued ID, a photo of themselves, an email, and phone number that are verified on the spot via passcodes.

Login.gov offers simple, secure, and private account set up and access to participating U.S. government agencies. Alternatively, users can access their accounts using ID.me a single sign-on login that verifies identity in multiple ways. Both services meet the U.S. government’s online identity proofing and authentication requirements.

The two-step verification was implemented to protect account holder’s information and deter fraudulent activity.

To open a personal Social Security account, or if a security freeze, fraud alert, or both on your credit report that, you can contact your local Social Security office for assistance or use ID.me.

Otherwise, you can temporarily lift the freeze by contacting SSA Identity Services Provider, and using the agency’s online service tools.

Related: How to Increase Your Social Security Payments

Despite the Recent Uptick, the Social Security Administration Is Progressively Getting More Secure

Despite the 31% uptick in allegations and scam reports filed between 2023-2024, the Social Security Administration’s security has improved significantly over the last 5 years.

The pandemic-related stimulus payments of 2020 caused a surge in Social Security related scams.

Those peaked in September 202, when more than 100,000 complaints were filed in that month alone. Between 2019–2021, an average of 50,000 reports were filed monthly, before declining precipitously in the second half of 2021.

Since then, monthly scam allegations have declined by approximately 80%, to between 5,000–10,000 reports per month.

The latest batch of cybersecurity measures are part of a comprehensive anti-fraud program that aims to improve government benefit administration.

Related: California Moves 42 Million Car Titles to Blockchain