In an uncharacteristic move that has all but thrown the stock market into disarray, Warren Buffett has sold over half his company’s Apple stock holding. Berkshire Hathaway cut their position in Apple down from $174.3 billion to $84.2 billion shares since the start of the year.

The surprising sale came two years after Buffett tagged Apple as one of Berkshire’s “four giants,” along with its insurance businesses, BNSF and Berkshire Hathaway Energy. Apple has been Berkshire Hathaway’s single largest holding since 2017.

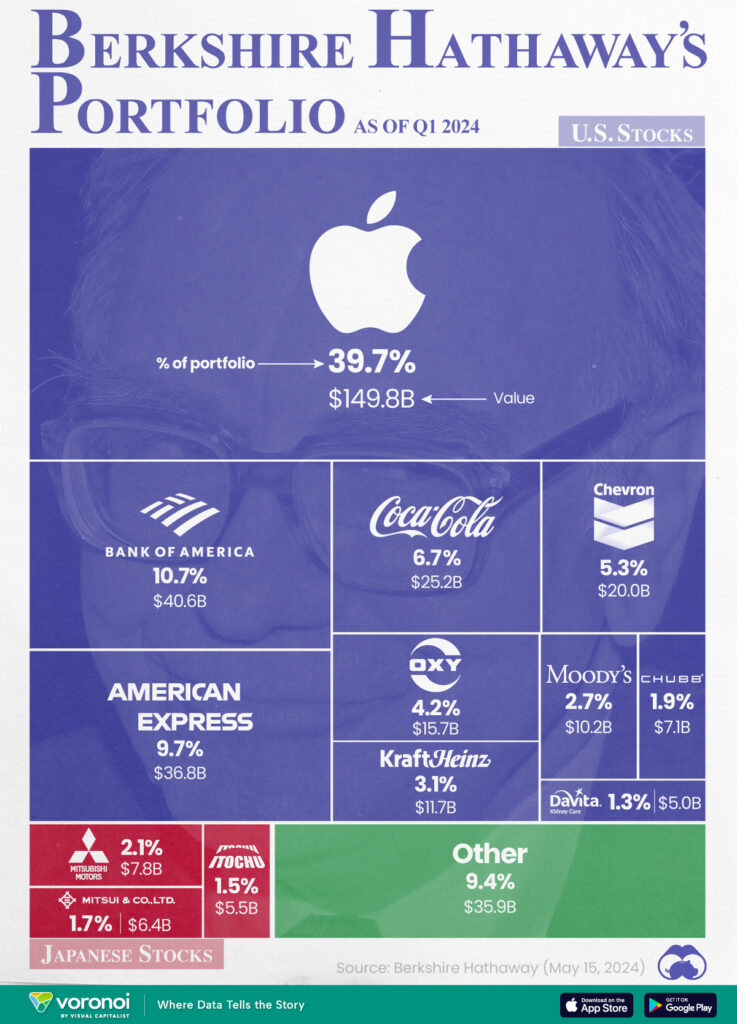

As of Q1 2024, Apple represented nearly 40% of Berkshire’s total portolfio.

That, however, didn’t stop him from selling over 500 million Apple shares, 115 million in the first quarter and another 390 million in the second. Despite selling more than 55% of its stake, Apple remains Berkshire’s largest holding — for now.

Whether Buffett will continue to sell his Apple holdings is unclear. The Oracle of Omaha has been exiting his position since late 2023.

Why Did Warren Buffett Sell Apple Stock?

On May 4, 2024, at this year’s annual Berkshire Hathaway meeting, Buffett made an appearance where he called Apple ‘an even better business’ than his other significant holdings, American Express and Coca-Cola.

He also shared that he expected Apple to remain Berkshire’s largest stock investment, a statement which holds true. Despite the massive sell, Apple maintains its position as Berkshire’s largest holding per a SEC quarterly report released on August 1.

Several reasons have been theorized as the cause of the sale. Reuters imagines it could be a defensive move regarding the US economy and the upcoming election cycle. Forbes, on the other hand, thinks the sale results from reduced faith in the company.

Apple has had a tumultuous few quarters. However, the iPhone maker showed signs of recovery in Q2 2024. On July 9, it became the first company to close a trading session with a market cap above $3.5 trillion, making it the most valuable company in the world.

Still, Apple has challenges ahead. The company faces several lawsuits in the U.S and the E.U. coupled with declining iPhone sales in China. The main catalyst for growth depends on its successful implementation of its A.I. strategy, where it faces formidable competition.

Souring Macroeconomics

Jim Shanahan, an Edward Jones analyst noted, “Buffett doesn’t seem to think there are attractive opportunities in publicly traded stocks, including his own. It makes me worry what he thinks about markets and the economy.” He further notes that “This could alarm the markets, especially given the news from last week,” referring to weak tech earnings, a disappointing jobs report, and uncertainty about the future of interest rates.

Apple isn’t the only one Buffett is offloading. Bank of America, which represented 10.7% of Berkshire’s portfolio in Q1 of this year was also on the chopping block. Berkshire has sold 89.6 million shares for over $3.5 billion since July 17, reducing its holding by 6.9% to 961.5 million shares. Berkshire remains Bank of America’s largest stakeholder, with a 12.4% stake worth $39.5 billion.

All these sales have not been kept liquid. instead the Oracle has chosen to reinvest in ‘the safest investment there is’: US Treasury bills. Currently, Berkshire has more Treasury bills than the Federal Reserve at $234.6 billion.

When asked about his ongoing streak of selling more than buying, Buffett said, “We’d love to spend it, but we won’t spend it unless we think we’re doing something that has very little risk and can make us a lot of money,” during Berkshire’s May 4 annual meeting.