Monday was the worst day in recent memory for thousands of traders around the world.

As the day drew to a close, the S&P 500 lost $1.3 trillion in value. CoinGecko data recorded a $350 billion-plus loss in the value of cryptocurrencies. In total, the weeks leading up to and including the crash saw stock markets around the world lose over $6 trillion in market capitalization.

“Call your mother,” popular market news source Unusual Whales wrote on X alongside a picture showing the crash. “Hurry.”

The following day, however, the worst seemed to be over.

“Thank you for calling your mothers yesterday,” Unusual Whales posted on Tuesday. “The market is now green.”

The shockingly steep — but potentially short-lived — crash was caused by a combination of factors. On Friday, the US Labor Department released an unexpectedly weak jobs report. Fears of an impending recession rose. They were compounded by disappointing earnings by major tech companies and escalating tensions in the Middle East.

However, the spark that ultimately lit this tinderbox alight came in the form of the Japanese Yen.

For years, the Bank of Japan has kept interest rates near zero. They’ve even gone into the negative.

Japanese Yen and Carry Trading

That encouraged investors to engage in what is called carry trading.

In carry trading, Investors borrow Yen, then invest that cash into other assets. The value of those assets would appreciate, and with no interest being charged, that appreciation was profit for the borrower.

According to a report from ING Bank, foreign borrowers had accumulated more than $2.2 trillion of loans in Yen. This money was invested all around the world, from US Treasury Bonds to various stock markets. Much of it was likely invested in the same tech companies that posted poor earnings reports just before the crash.

However, there was a catch. If the value of the borrowed Yen were to increase by more than the appreciation of the assets it was invested in, then investors would be upside down on their loans.

That’s exactly what happened. Earlier this year, the Bank of Japan set its key interest rate above zero for the first time in nearly two decades.

At the end of July, it did so again. Meanwhile, the US Fed is widely expected to lower interest rates.

Japanese Yen Gains Value on the Dollar

This shift caused the Yen to gain value against the dollar. Conversion rates went from 161 Yen per dollar, a historic low in mid-July, to 141 Yen per dollar on Monday morning — a 14% value gain in a matter of weeks.

Those trillions of dollars in Yen investments, made on the assumption that the Yen would remain weak against the dollar, were suddenly deeply in the red.

This prompted investors to begin “unwinding” their carry trades, or returning the money they had borrowed. The process quickly snowballed.

“You can’t unwind the biggest carry trade the world has ever seen,” Kit Juckes of Societe Generale noted on Monday, “without breaking a few heads.”

The crash wasn’t a surprise to everyone.

“All signs have been pointing to this trend for a few months,” one Reddit user living in Japan commented, “and we are LONG overdue a correction in Japanese equities.”

Is It Over Now?

Indeed, some models suggest the Yen could be undervalued by as much as 70%.

“I think ‘the end of the carry trade’ is kind of hyperbole,” another Reddit user wrote. “This seems like just a short term blip where a few traders got margin called and spooked.”

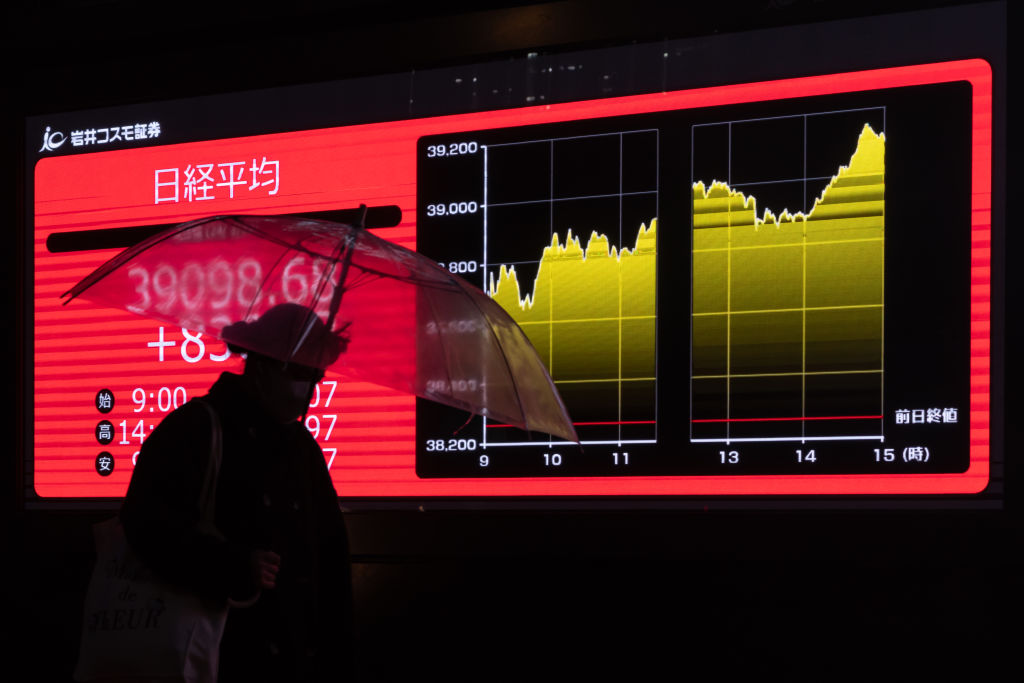

Tuesday saw a recovery in the S&P 500, Japanese Nikkei 225 Index, and crypto market cap.

The crash, then, could be over — a flash in the pan.

However, not everyone is convinced things are over just yet.

“There is still a large amount of capital deployed on the basis of the Japanese Yen staying weak forever,” Tony Daltorio of Barchart warned. “So the danger is still there.”

The Yen is currently hovering at around 147 Yen to the dollar.