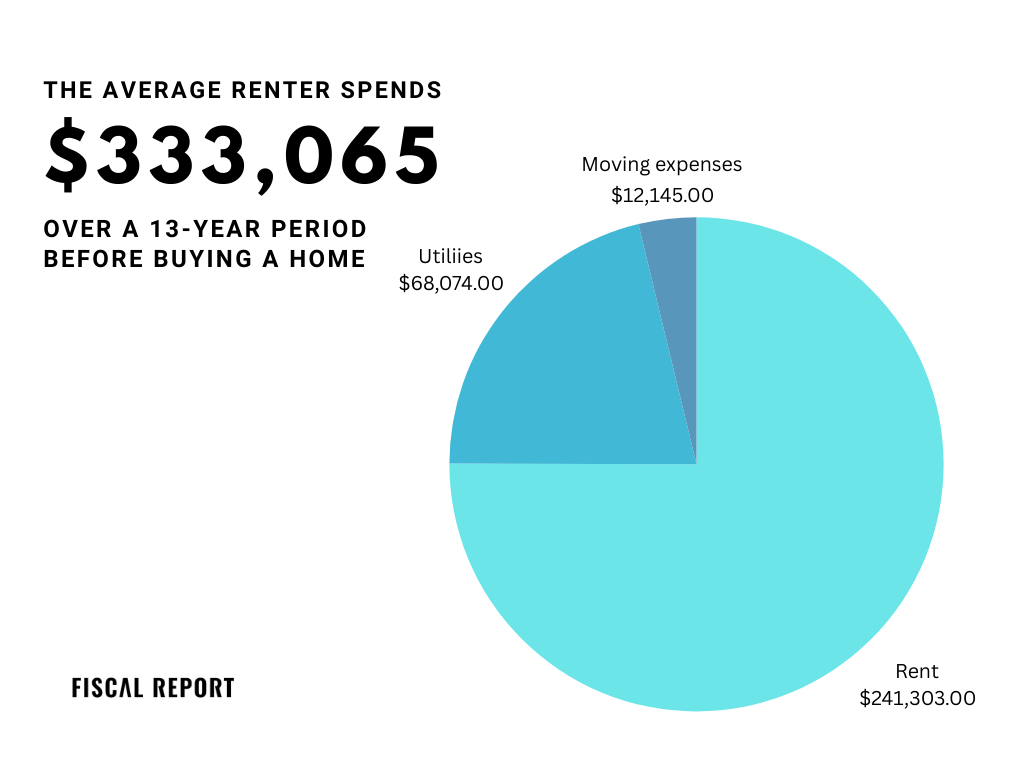

A new study by Self Financial shows that the average American home renter spends $333,065 on renting-related expenses, including monthly bills.

The study used National Association of Realtors statistics suggesting that the average American starts renting at the age of 22, buys their first home at age 35, and spends an average of $25,620 per year on rent and related expenses.

The expenses included utilities, furniture, security deposits, insurance, and moving costs. Average rent totaled $241,303 for the 13 years between renting their first place and buying their own home. Utilities cost $68,074; moving costs averaged $12,145 over the same 13-year period.

Self Financial cited publicly available pricing information from websites like Zillow, RentCafe, and Insure.com. It chose the 22-35 age range based on information from the National Association of Realtors.

Most Expensive States for the Average Renter

The five most expensive places for renters were:

- Hawaii ($599,242)

- Colorado ($540,772)

- District of Columbia ($479,998)

- Maine ($451,217)

- California ($448,852)

The five least expensive places were:

- Kansas ($228,225)

- Wisconsin ($240,913)

- Idaho ($244,551)

- Nevada ($244,782)

- Mississippi ($249,329)

Self Financial emphasized that these figures represent the stark differences in the cost of living between states or districts in the United States.

Like many economic sectors, inflation has hit the rental market hard. Data from Moody’s indicates that households spent 30% of their income on rent in 2023, compared to 25% in 2020.

CoreLogic Principal Economist Molly Boesel acknowledges the steep jump in a quote she provided to Fortune, saying that rent spiked “by double digits for most of 2021 and 2022.” However, “at the end of 2023, they did slow to the mid-2% range. While single-family rents are increasing at a stable rate, median rent continues to rise.”

Related: Attorney General Merrick Garland Sues Lardlord Software Company RealPage for Rent Price Fixing

Sotheby’s International Realty associate broker Nikki Beauchamp described households that spend 30% or more of their income on rental housing as “rent-burdened.” Beauchamp indicated that rent prices may be part of the reason people are hesitating to start families and struggling to save for a down payment on a home.

“Delays in household formation will keep people as renters for longer periods of time and that means people will gradually spend more on rent over their lifetimes,” she told Fortune.

Rental Property Ownership

According to statistics from iPropertyManagement, corporations own 45% of residential rental units and 18.8% of residential rental properties. Individual landlords own 41.2% of rental units and 71.6% of rental properties. Individual landlords are 3.32 times more likely than corporations to own a single-unit rental property. Multi-unit properties are also typically outside the price range of a typical mom-and-pop landlord, and more likely to be bought by corporations.

iPropertyManagement also says that 79.8% of rental units are owner-managed, meaning the landlord has not hired a property manager.

Interestingly, iPropertyManagement says 35.8% of rental businesses fail within the first five years, and 21.9% of landlords may be unaware of programs like the Emergency Rental Assistance program.

This program can help landlords avoid evicting tenants who fall behind on their rent. These programs were designed to help those in difficult financial times as many struggle to keep up with the rising cost of living.