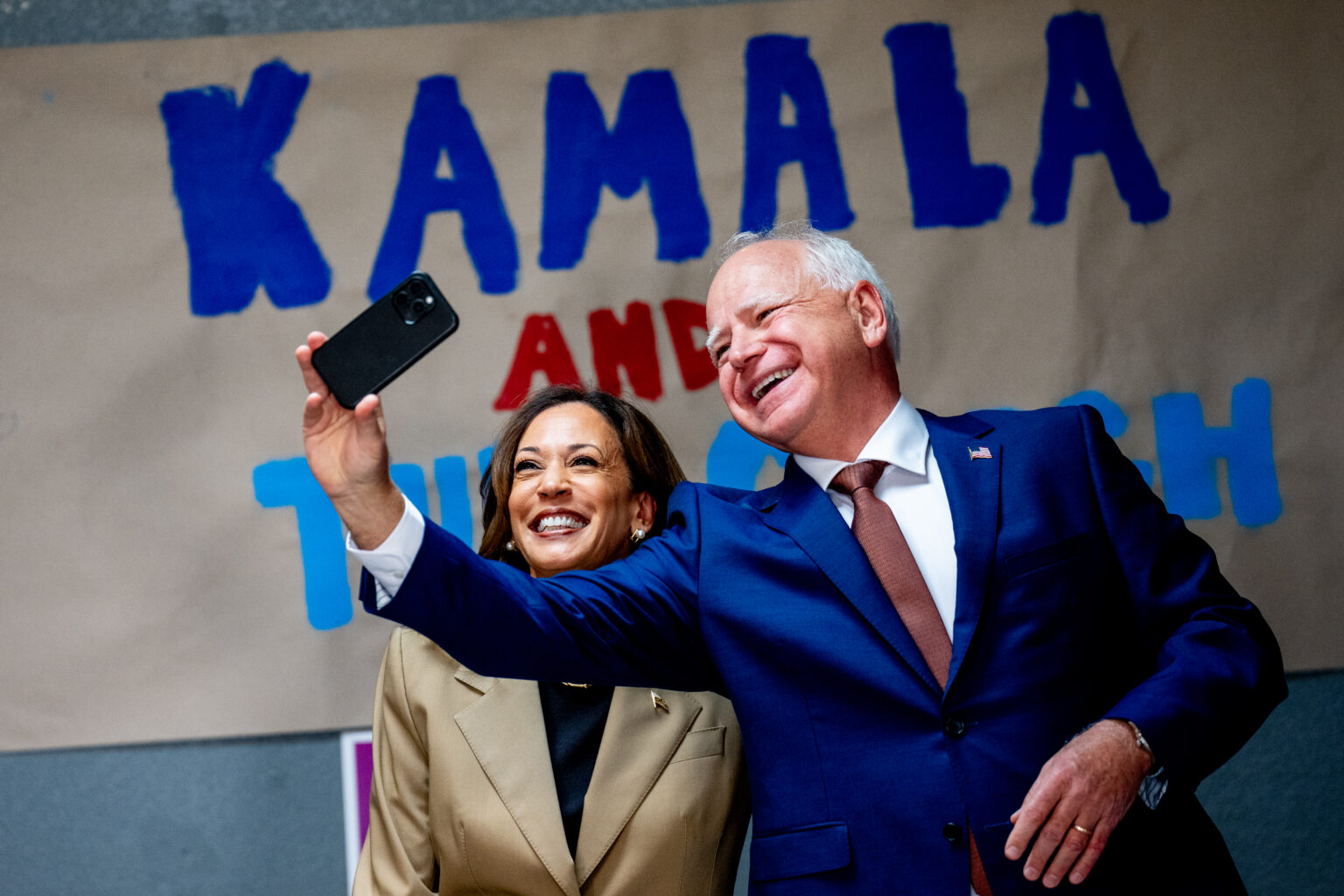

At the 2024 Democratic National Convention, the Harris-Walz campaign outlined their vision for revitalizing the U.S. economy if elected.

In August, while speaking at a rally in Raleigh, North Carolina, Vice President Kamala Harris introduced what she calls an “opportunity economy,” emphasizing equal chances for all Americans to compete and succeed.

Addressing the ongoing housing crisis, which has seen prices soar to record highs, Harris proposed a tax incentive for developers to construct 3 million starter homes over the next four years. This policy aims to alleviate the affordability challenges that have left many unable to secure housing.

In alignment with President Joe Biden’s Fiscal Year 2025 budget, Harris reaffirmed her commitment to supporting middle- and low-income households. She vowed to maintain the current tax provisions that prevent any tax increases for those earning $400,000 or less. Moreover, her policy proposals offer various additional benefits for Americans who fall into these tax brackets.

Among them, the Harris-Walz policies also pledge to expand the Child Tax Credit, a program initially introduced during the COVID-19 pandemic.

Under her plan, families will receive $3,600 per child under six years old and $3,000 for children aged six and above. Families with newborns will be eligible for an additional $2,400, totaling $6,000 in benefits.

In a bid to make tax benefits more equitable, Harris proposes reforming the Earned Income Tax Credit (EITC) to increase benefits for individuals without children, a group currently receiving fewer tax advantages.

In a notable policy convergence, Harris echoed former President Trump’s proposal to eliminate taxes on tips, which could significantly benefit service workers. However, economists have criticized this idea as a populist move that could have broader negative implications.

Related: Trump Presidency Will Reignite Inflation, 16 Nobel-Winning Economists Say

On healthcare, Harris aims to build on Biden’s $35 cap on insulin, seeking to extend it to all Americans. She also vowed to introduce a $2,000 yearly cap on out-of-pocket drug costs. As current Vice President, Harris has already made moves on this front.

In August, the Biden-Harris Administration announced a historic Medicare price negotiation deal for ten common, and sometimes lifesaving prescription drugs.

To fund her policies, Harris plans to raise the corporate tax rate to 28%, reversing a cut enacted during the Trump administration. Experts estimate that this increase could generate $96 billion in revenue over the next decade.

Additionally, Harris supports the Biden Administration’s proposed tax on unrealized capital gains for individuals earning $100 million or more, targeting the top 1% of wealth holders who have significant assets tied up in stock holdings.

The Democratic nominee unveiled plans to address offshore tax evasion by eliminating foreign tax havens. Her proposal would impose the same tax rate on offshore corporate income as domestic income. This move aims to curb multinational companies from shifting operations to low-tax jurisdictions to avoid U.S. taxes.

Harris has also outlined measures to combat anti-competitive market practices. One key initiative targets large property owners who use pricing algorithms to coordinate rent increases across multiple properties. This practice, known as price fixing, exacerbates the housing crisis. The Department of Justice has already filed a lawsuit against landlord software company RealPage for artificially inflating rent costs nationwide.

Additionally, her administration would empower the Federal Trade Commission to block mergers between food companies, a step intended to prevent monopolistic control and protect consumer prices in the food industry.

These policies highlight Harris’s focus on closing corporate tax loopholes and increasing regulatory oversight to foster fair competition in key sectors of the economy.

Whether or not the Harris-Walz policy proposals will resonate with voters remains to be seen. Nationally, Harris leads Trump in the polls by a safe margin.

But in seven key states, the two are essentially tied. Enough wins for either candidate in these swing states could turn the tides of the November election.

Related: Wharton Study Finds Trump’s Policies Will Add $4.1 Trillion to Debt, Kamala’s $1.2 Trillion