The U.S. Bureau of Labor Statistics says nationwide car insurance rates have risen by nearly 50% since 2020.

In January 2020, the average car insurance premium was $572.93. In June 2024, the national average exceeded $843.

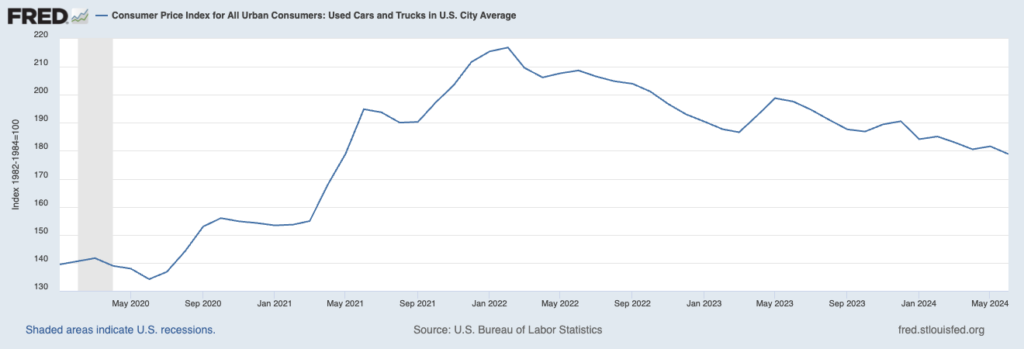

Unstable Auto Prices

Sharp increases in vehicle prices during the same period explain most of the insurance premium hikes. The Consumer Price Index for vehicles was 139.424 in January 2020. It increased to 178.831 in June 2024.

This index is based on used car prices between 1982-1984, which the Federal Reserve Bank of St. Louis uses as a benchmark (100). Due to the increased Consumer Price Index on autos — and the fact that their costs have fluctuated significantly over the last 4 years — insurance companies find it difficult to underwrite policies.

Increased Vehicle Accident-Related Fatalities

According to statistics published by the National Highway Transportation Safety Administration (NHTSA), vehicle accident fatalities totaled 36,355 in 2019. That figure increased by 7.3% to 39,007 in 2020, and then by 10.8% to 43,230 in 2021. Fatalities declined by 1.7% to 42,514 in 2022 and by 3.6% to 40,900 in 2023 — but remain elevated over pre-2020 levels.

Statistics such as the Consumer Price Index for vehicles, fatal crashes, common driving conditions in the city or state that a vehicle owner lives in, and the rate at which driver error contributes to crashes, are all factors for increased insurance rates.

The NHTSA removed references to an often-cited 2015 study that shows driver error contributed to more than 90% of fatal accidents after backlash from street safety advocates.

Advocacy groups dispute the study’s findings, asserting that unsafe driving conditions, lax enforcement of vehicle- and driving-related laws and regulations, and misleading traffic laws are all likely contributors to accidents. Some street and highway designs can also contribute to crashes, especially at intersections, highway exit and entry ramps, and areas where drivers frequently merge or change lanes.

Driver Errors

However, that does not mean vehicle occupants aren’t error-prone.

The NHTSA found that 58% of vehicle occupants in nighttime fatalities in rural areas and 56% of those in urban areas were not wearing seat belts.In 2022, 11,000 of the killed vehicle occupants were not wearing seat belts.

The NHTSA’s statistics also show that speeding was a factor in 29% of fatal crashes in 2021. Speeding-related fatal crashes increased by 8% from 2020 to 2021.

Driving under the influence was a factor in 32% of fatal crashes. In 2022, 13,524 people died in accidents involving drunk drivers.

Some vehicle manufacturers have attempted to help consumers mitigate rising premiums through technologies that provide driving data to insurance companies. But the extent of what data is being monitored and just how it can affect insurance premiums is unclear.

A recent lawsuit filed by Texas Attorney General Ken Paxton against GM charges that the automaker sold data collected by vehicle on-boarded systems to insurance companies who consolidated it into a score used in underwriting. Whether such scoring could be used to adversely impact premiums in unclear.

For instance, Tesla piloted an insurance program that provides dynamic rates based on individual Tesla vehicle owners’ driving metrics. The program does not require any additional hardware in a Tesla vehicle. The program is designed to reward safe driving behavior.

Car insurance is still another area in which consumers have felt the pinch of rising prices. Premiums have gone up by nearly 50% since 2020, at least partly due to insurance companies’ lack of an appetite for the higher financial risk that comes with higher vehicle prices.

Related: California DMV Moves 42 Million Car Titles to Blockchain