The United States’ national debt passed $35 trillion on July 28, 2024.

According to the Treasury Department, national debt grows every year the government runs a deficit. Deficit is created when the government spends more than it brings in from all sources, including tax revenue.

Since Q1 2020, the national debt has grown from $23.2 trillion to the current level of $35 trillion. That’s a 66% growth in less than five years.

In the previous four-year period, from Q1 2015 to Q4 2019, the country’s debt grew from $18.15 trillion to $23.2 trillion — a 78% jump.

The U.S. Bureau of Economic Analysis says the United States’ Gross Domestic Product (GDP) was approximately $27.36 trillion in 2023. GDP is a metric used to calculate the total economic output of the country per year. In other words, it’s the country’s income.

Deloitte Insights predicts that the GDP will grow by 2.2% to $27.96 trillion in 2024, accounting for the Treasury Department’s ongoing efforts to keep inflation under control.

The U.S.’s national debt surpassed GDP in 2013.

Public Debt Per Citizen

Although politicians have thrown caution to the wind when it comes to the country’s increasingly precarious debt situation, the current public debt is approximately $103,900 per citizen.

That’s only slightly less than the average personal debt that each U.S. resident owes, which is about $104,215 per person. That figure includes mortgages, credit card debt, auto loans, and student debt.

Projections from the Peter G. Peterson Foundation and Brookings show that the U.S. government will pay $894 billion in interest payments alone on the national debt this year – 13% of the federal budget. The Peter G. Peterson Foundation also projects that the debt’s interest payments will reach 15.3% of the federal budget by 2031.

At this rate, United States will spend 20% more on interest payments than on national defense by 2032. National defense is typically one of the biggest line items in annual federal budgets.

Congress authorized a budget of $842 billion for the Department of Defense for Fiscal Year 2024. Based on the Committee for the Responsible Federal Budget’s most conservative estimate, national debt could reach $42.9 trillion by 2032 — 116% of the U.S. GDP.

Implications of Burgeoning National Debt

What happens if the United States defaults on its debt? The most likely scenario is that “non-essential” federal employees are forced to take unpaid time off until Congress agrees to raise the debt ceiling.

If a Congressional standoff on the debt ceiling lasts too long, these employees may find themselves out of work.

In an extreme scenario, failure to address the national debt can also impact government contractors. Government agencies may be forced to lay off employees or even shut down all together if the federal government cannot fund its obligations.

The growing national debt can also hurt the United States’ credit rating. That in turn affects the interest rate at which the government can borrow money.

Standard & Poor dropped the United States’ credit rating from AAA to AA+ in August 2011. They cite the government’s lack of a comprehensive plan to manage debt and annual deficits.

Likewise, Fitch Ratings lowered the credit rating from AAA to AA+, citing rising debt, deterioration in government standards, and repeated political standoffs over the national debt. These ratings are reflective of a government’s ability to pay off its debts. Annual deficits already include double-digit percentages of the federal budget devoted to paying interest on the debt.

Presidential Nominees Plans For Public Debt

Both Presidential candidates Donald Trump and Kamala Harris‘s plans would only add to the runaway debt. Economists at the Wharton School at the University of Pennsylvania estimate that Trump’s proposed economic policies would add $5.8 trillion to national debt over a 10-year period; Kamala’s recently released economic policies would add $1.2 trillion over the same timeframe.*

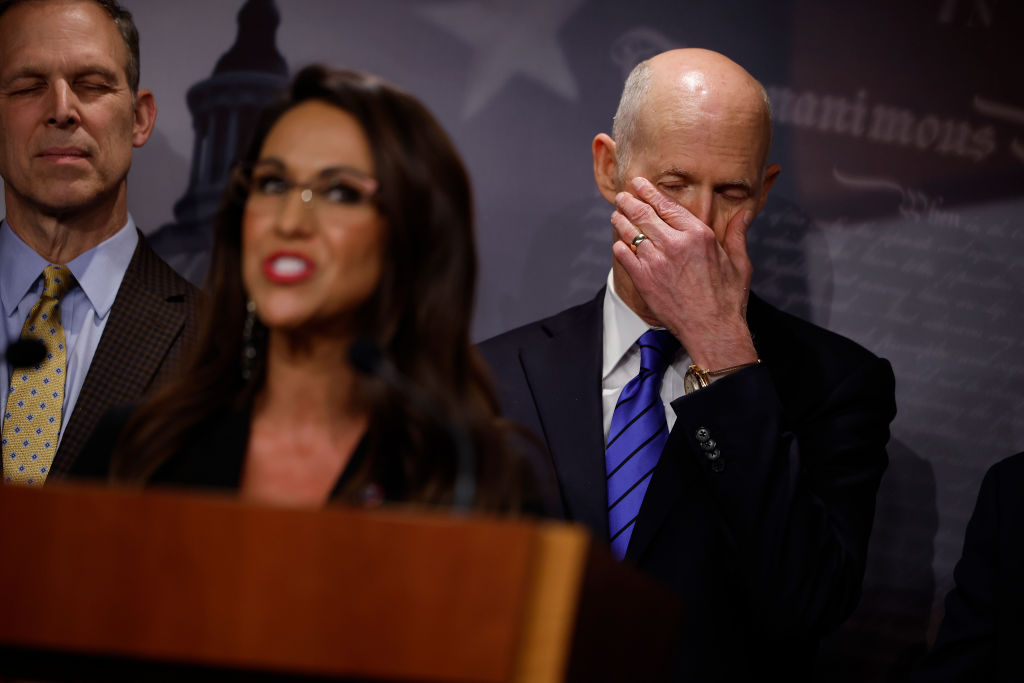

Meanwhile, a group lead by former Vice President Mike Pence recently outlined an actionable blueprint on reducing national debt. Pence had run for the GOP nomination earlier nomination in 2023, but dropped out in October.

Unless something changes, the national debt and interest paid on it are projected to rise significantly for the foreseeable future.

The Congressional Budget Office forecasts that at current growth rates, every U.S. citizen will hold more than $1 million in pubic debt by 2053.

*Update, 9/1: An earlier version of this article stated that both presidential candidates’ polices would add to the national debt, but did not include estimates of by how much, or which candidate would fare better by this measure. After Kamala Harris released an outline of her economic policies, experts at the Wharton School estimated the total fiscal impact of each candidates’ policies and provided the estimates which were later added to this article.