Another year, another tax bill.

But without action from lawmakers, Americans are in for an unpleasant surprise in 2026. The expiration of Trump-era tax cuts means higher tax rates for almost every income bracket. With rate hikes on the near-term horizon, planning for the years ahead may be necessary to avoid surprise expenses.

Why Taxes Will Go Up in 2026

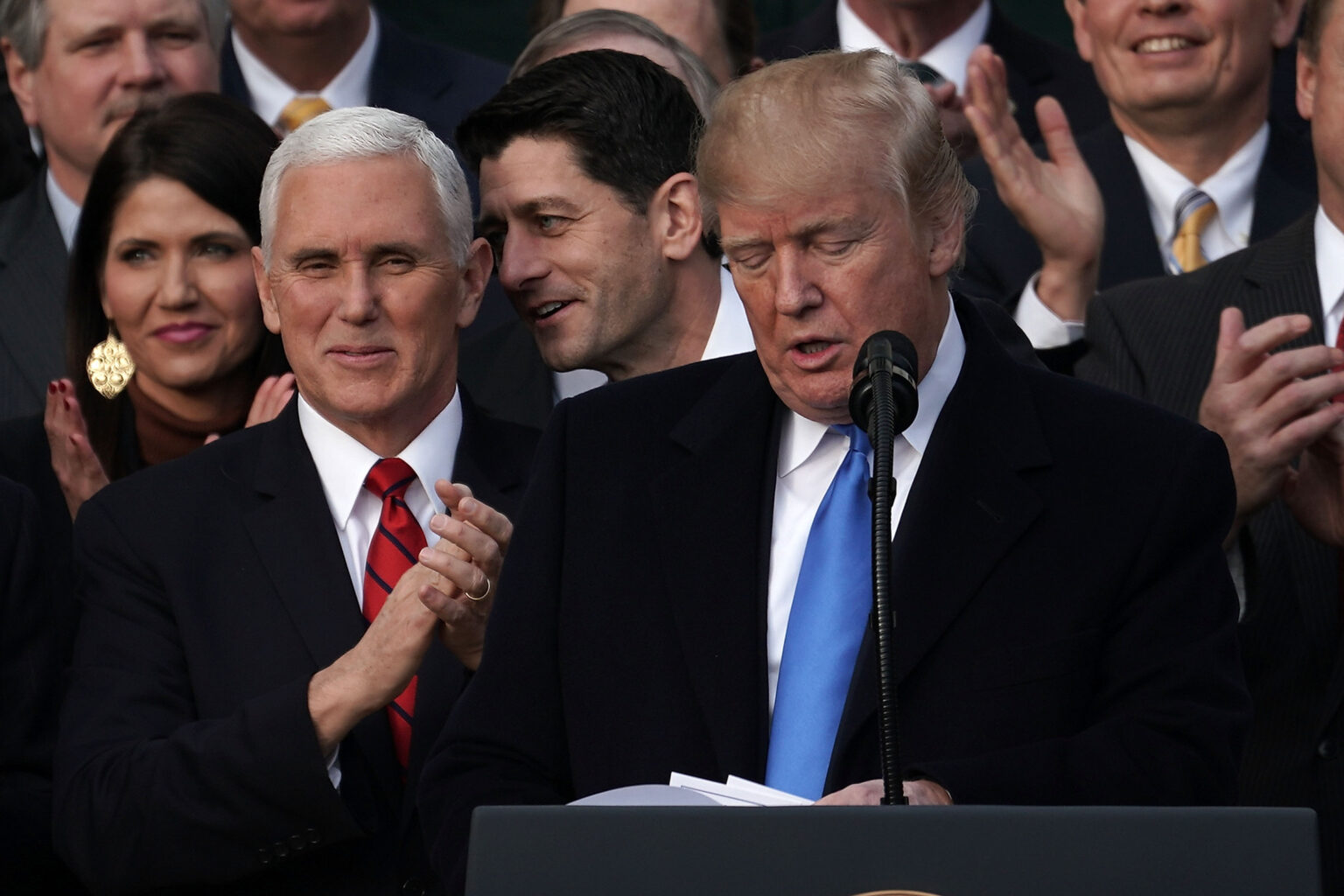

The Tax Cuts and Jobs Act, enacted in 2017, lowered Americans’ tax rates in several ways. Most notably, it raised the standard deductibles for both singles and married couples, lowering taxable income and therefore overall taxes due across the board.

However, the bill was passed with an expiration date — December 31, 2025.

At least, that’s when the provisions for the common taxpayer expire. The 50% corporate tax cut — passed in the same act — has no expiration date.

Here’s what the average taxpayer can expect in the coming years as the temporary yet beneficial provisions of the bill approach their expiration date..

Deductibles, Now and After Sunset

The standard deduction lowers taxable income.

For someone making $75,000 a year, they can subtract the standard deduction amount from their income that year. That portion is not taxable. Whatever remains thereafter, however, is subject to taxation.

The Tax Cuts and Jobs Act nearly doubled the standard deduction, effectively lowering the average American’s tax burden.

| 2023 | 2024 (+5%) | 2026 (after sunset, -75%) |

| $13,850 (single) $27,700 (married, filing jointly) $20,800 | $14,600 (single) $29,200 (married filing jointly) $21,800 (head of household) | $8,300 (single) $16,600 (married filing jointly) $9,350 (head of household) |

By default, an additional $6,300 of income that was not taxable in 2024 will be taxable in 2026. That’s a minimum of $630 increase in taxes for anyone making over $14,400 in income per year.

Tax brackets will be lowered too, meaning high taxation rates on lower levels of income. After the lowered Standard Deduction is subtracted from net income, the first $11,600 is taxable at 10%. while anything above $11,600 is taxable at a 12% minimum.

In 2026, that level will drop to $9,350. And anything above that will be taxed at 15% minimum.

Other Implications of the Tax Cuts And Jobs Act 2026 Sunset

Should the tax law expire without an extension or updated chart, the following changes would be applicable for 2026:

- The standard deductible for an individual would shrink to $8,300. Married couples would only be able to deduct $16,600 as a standardized deduction. By comparison, the standard deductible for 2024 is $14,400 and $29,200 for jointly filing married couples. That means a higher percent of income is taxable.

- Tax rates will remain in seven different brackets, but the rate of taxation would increase for all but the lowest tax bracket at 10 percent. The highest-paid tax bracket would pay a marginal rate of 39.6 percent of any income over $609,

- Child tax credits would begin to phase out at $110,000 per family rather than $400,000, and revert back to $1,000 per dependent as opposed to $2,000.

- Estate and gift tax maximums would drop to an exclusion of $7.15 million per person.

No Sunset In Sight For Corporations

While the tax bill decrease for the general population was temporary, the corporate tax — cut from 35 percent to 21 percent — is permanent fixture unless Congress enacts new tax laws.

The corporate tax credit has lowered national tax revenue by $280 billion since 2018. Over the same period, national debt increased by just under $19 trillion.

Related: Second Trump Presidency Will Reignite Inflation, 16 Nobel-Winning Economists Say

More Debts, Bigger Tax Burdens

The lapse of the Tax Cuts and Jobs Act would place an increasingly heavier strain on middle-income Americans. Whether or not politicians will change course on tax reform to decrease tax burdens on the general population remains to be seen.

Considering national debt just surpassed $35 trillion, tax increases in the future are inevitable. But where those funds will come from is uncertain.

Both Democrat and Republican politicians have voiced support for keeping many of the cuts that came with Trump tax reform legislation. Both sides of the political spectrum have been eyeing keeping at least three-quarters of the current tax cuts in effect.

President Biden has endorsed keeping Trump’s tax cuts permanent for all households earning under $400,000.

The Biden Administration has endorsed keeping the current child tax credit, which provides a $2,000 tax credit per child and was granted to nearly 40 million families and has been a very popular stipulation among voters.

If the Tax Cuts and Jobs Act were to sunset at its scheduled time, the IRS would be able to collect approximately $400 billion more tax revenue per year.

The proposed expiration of the Tax Cuts and Jobs Act would affect almost every American taxpayer. The Cato Institute noted that the increases would affect approximately 95 percent of all taxpayers.