As food prices continue to climb, consumers are noticing a growing trend of smaller portions at the same prices—a phenomenon known as “shrinkflation.”

While this practice began to gain traction in the 2010s, it has become increasingly prevalent today, with many household items and popular food brands downsizing their offerings without adjusting the retail price.

From canned goods to everyday essentials, shrinkflation is reshaping consumer expectations and purchasing habits across the market.

These are nine popular items that have succumbed to this penny-pinching trend.

Doritos

Fans of bold, spicy corn chips may be in for a disappointment.

A recent Senate investigation into shrinkflation found that Frito-Lay, the company behind Doritos and Lay’s potato chips, reduced the size of its packages from 9.75 ounces to 9.25 ounces—while keeping the price per bag the same.

This means consumers are paying more per chip, highlighting the growing trend of shrinkflation impacting everyday products.

Cocoa Puffs Cereal

Are you cuckoo for Cocoa Puffs?

If you’re a fan of most General Mills cereals, you might have noticed their cereal boxes feeling a little lighter. A Senate review revealed that General Mills Family Sized cereals went from 19.3 ounces to 18.1 ounces.

To add insult to injury, shrinkflation on these products was later followed by traditional price hikes.

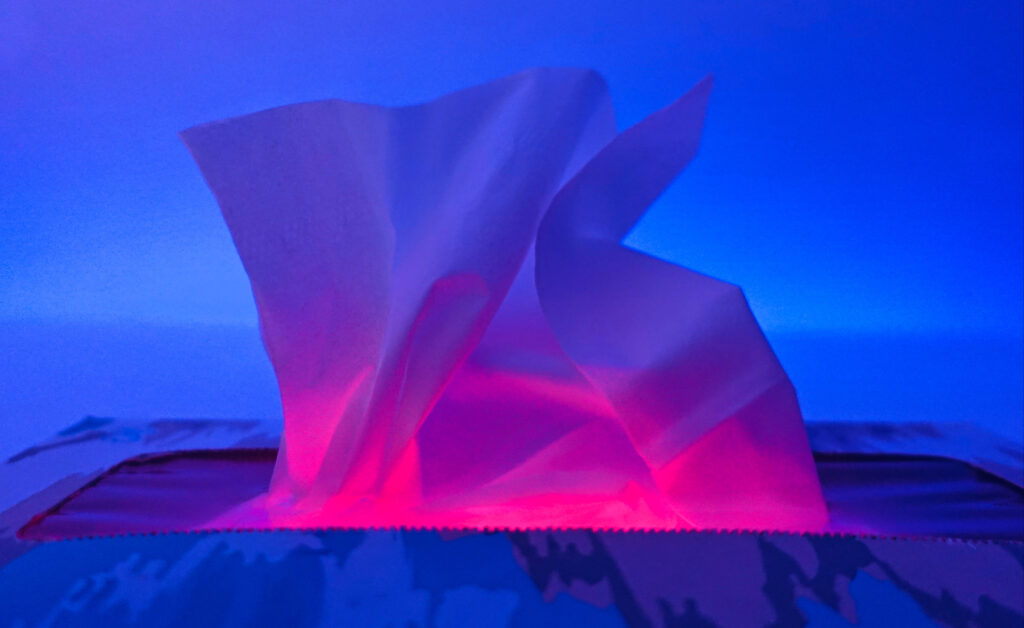

Kleenex

While products like Doritos and cereals have drawn the most attention for shrinkflation, the trend extends beyond just food items, unfortunately.

In 2022, Kleenex quietly reduced its tissue pack size from 65 to 60 tissues. followed by a conventional price hike shortly after. A traditional price increase followed shortly after.

Gatorade

Gatorade has been the go-to drink of football and other athletes for aeons—but even its breakout popularity didn’t stop it from being a victim of shrinkflation.

A Quartz exposé revealed that the bottle’s new redesign was a slick way to drop the serving size from 32 to 28 ounces—roughly the same as increasing the price by 14 percent.

Oreos

Oreos are among the other snack foods hit by shrinkflation, as flagged by Senator Bob Casey’s investigative report.

Double Stuf Oreos, in particular, were singled out for having a 6 percent decrease in weight. They went from 1 pound and 4 ounces per pack to 1 pound and 2.71 ounces—about a 1.3 oz decrease.

Not a huge decrease, but one every Oreo lover will notice after they’ve eaten what should have been the second-to-last cookie.

Dawn Ultra Dish Soap

Another common household item on Senator Casey’s report: Dawn Ultra (among other products from this brand) kept their soap bottles the same.

However, they decreased the amount of dish soap put into each bottle by 7 percent.

Proctor and Gamble later said they saw no need to offer sales or price cuts while in the same meeting, disclosing over $10 billion in profit—for the quarter.

Hershey’s Chocolate Kisses

Much to the chagrin (and dismay) of home bakers everywhere, an 18-ounce package of Hershey’s Kisses is no longer its traditional size.

In 2021, Hershey decided to shrink its standard Kiss packages to 16 ounces. Price per package was still increased by 7% in 2023 and by another 9% in 2024, per their Q1 earnings report for 2024.

However, Hershey’s price hikes and smaller packages are justifiable_modest, even. Globally, the price of cocoa has more than quadrupled over the last two years alone.

Campbell’s Soup

Campbell’s is the latest brand to come under scrutiny for shrinkflation, with some of its soups shrinking by between 5.5-13.3%, depending on the can size, in their “New Look” cans. The updated cans were made taller, but narrower to disguise the downsizing.

Campbell’s has been leading the charge on the skrinkflation front, as this is hardly a new move from them. This Reddit post from nine years ago shows a downsizing from yesteryear.

This more recent cut is from an already downsized can.

Tide Laundry Detergent

Doing your laundry just got a whole lot more expensive.

GoBankingRates noted that a Tide Box shrank from 254 ounces to 232 in 2023. Many other detergent companies have also followed Tide’s lead, often following up the shrinkage with a traditional price hike.

Any views or opinions expressed are solely for informational purposes and do not reflect support or opposition to any political party, organization, or individual involved. Neither Fiscal Report nor this article’s author receive a commission through links in this content.